cryptonesia5758.site

Overview

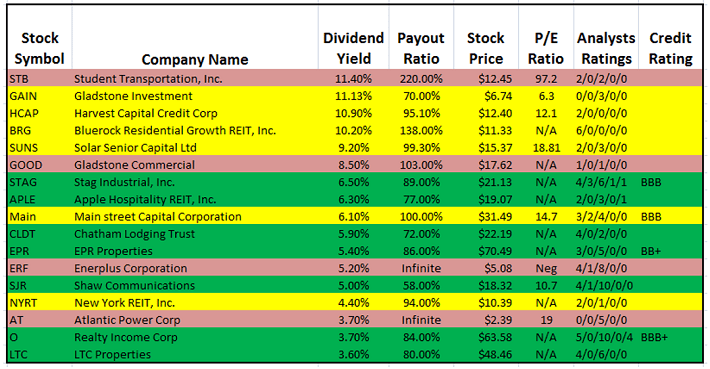

Best High Dividend Paying Stocks List

list of shareholders to determine who is eligible to receive the upcoming dividend Helps in stock evaluation: Companies that pay dividends tend to have good. Looking for the best dividend stocks to buy? Here's a list of the 50 highest dividend paying stocks with strong fundamentals for The top dividend-paying stocks for August include the transportation companies BW LPG Ltd. (BWLP) and Hafnia Limited (HAFN), along with the gas- and oil-. As you review our list of companies offering the highest dividends, you may come across names that are well-known as well as those that are less familiar but. Monthly Dividend Stock # Oxford Square Capital (OXSQ) · Monthly Dividend Stock #1: Itau Unibanco (ITUB) ; 5-Year Expected Total Return: %; Dividend Yield. Highest Dividend Paying Stocks ; IEP, Icahn Enterprises, , , % ; BGH, Barings Global Short High Yld Fund, , , %. US companies with the highest dividend yields ; PETS · D · %, USD, +%, K ; RILY · D · %, USD, −%, M. Below you'll find a list of the highest yielding Dividend Aristocrats. Dividend Aristocrats are companies that are part of the S&P and have increased their. Top Highest Dividend Yield ETFs ; TSL · GraniteShares x Long Tesla Daily ETF, % ; MRNY · YieldMax MRNA Option Income Strategy ETF, % ; NVDY. list of shareholders to determine who is eligible to receive the upcoming dividend Helps in stock evaluation: Companies that pay dividends tend to have good. Looking for the best dividend stocks to buy? Here's a list of the 50 highest dividend paying stocks with strong fundamentals for The top dividend-paying stocks for August include the transportation companies BW LPG Ltd. (BWLP) and Hafnia Limited (HAFN), along with the gas- and oil-. As you review our list of companies offering the highest dividends, you may come across names that are well-known as well as those that are less familiar but. Monthly Dividend Stock # Oxford Square Capital (OXSQ) · Monthly Dividend Stock #1: Itau Unibanco (ITUB) ; 5-Year Expected Total Return: %; Dividend Yield. Highest Dividend Paying Stocks ; IEP, Icahn Enterprises, , , % ; BGH, Barings Global Short High Yld Fund, , , %. US companies with the highest dividend yields ; PETS · D · %, USD, +%, K ; RILY · D · %, USD, −%, M. Below you'll find a list of the highest yielding Dividend Aristocrats. Dividend Aristocrats are companies that are part of the S&P and have increased their. Top Highest Dividend Yield ETFs ; TSL · GraniteShares x Long Tesla Daily ETF, % ; MRNY · YieldMax MRNA Option Income Strategy ETF, % ; NVDY.

Use Barchart's Top Dividend Stocks list to identify today's stocks paying the highest annual dividend yield. Highest Dividend Paying Large-Cap Stocks. The largest high dividend yield ETF is the Schwab U.S. Dividend Equity ETF (SCHD). The Vanguard High Dividend Yield ETF (VYM) is also a popular high dividend. With 2, constituents (as of ), the FTSE All-World High Dividend Yield index is by far the largest available dividend index. The selection method is. Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks. Companies ranked by Dividend Yield ; favorite icon, Great Ajax logo. Great Ajax. 91AJX. %. $ % ; favorite icon, SandRidge Energy logo. dividend-paying stocks play in your portfolio “One mistake to avoid,” Cabacungan says, “is to buy a company's stock simply because it issues a high dividend. Seeks to track the performance of the FTSE® High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by high. Top Dividend Stocks ; McDonald's. 26/08 |MCD. ; P&G. 26/08 |PG. + ; J&J. 26/08 |JNJ. + ; Realty Income. 26/08 |O · + Best Dividend Stocks ; AGNC Investment Corp. stock logo. AGNC. AGNC Investment. $ %, 3, ; Walgreens Boots Alliance, Inc. stock logo. WBA. Walgreens. The top dividend-paying stocks for August include the transportation companies BW LPG Ltd. (BWLP) and Hafnia Limited (HAFN), along with the gas- and oil-. Chevron (CVX) International Business Machines (IBM) and Altria Group (MO) are some of the most trending Dividend Stocks. Best dividend stocks ; Comcast Corp. (CMCSA). Comcast Corp. (CMCSA) · Highly recurring revenue and cash flow create significant financial visibility. ; Bristol-. 15 Companies That Have Paid Dividends For More Than Years ; E I Du Pont De Nemours And Co (DD) -- NO. Dividends Paid Since DuPont (DD) ; General Mills. World's companies with the highest dividend yields ; EEWINT · D · MYX, %, MYR ; PETS · D · NASDAQ, %, USD. Dividend Growth Focused. Move right. The iShares Core Quality Dividend ETFs invest in good quality companies that pay high and sustainable dividends. They are. Seeks to track the performance of the FTSE® High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by high. Top Dividend ; 1. CHW ; 2. HAL ; 3. CUEH ; 4. ZUM. High Yield Dividend Stocks ; Enviva Inc. stock logo. EVA. Enviva. $ +%, % ; ESGL Holdings Limited stock logo. ESGL. ESGL. $ %, %. Check out stocks offering high dividend yields along with the company's dividend history. You can view all stocks or filter them according to the BSE group or.

Loan Syndication Process

Syndicated loans are complex and may be risky given the credit quality of borrowers tapping the syndicated loan market may be below investment grade. Loan. When multiple banks or lenders come together to arrange for the loan requirement of a single borrower, it is referred to as a loan syndicate. Loan syndication is the process of multiple lenders coming together to fund a large loan requirement of a single borrower. This process is required when the. For banks involved in loan syndication, the three distinct stages of the process offer different levels of competition law risk. • Before the syndication group. Loan syndication is initiated by a client who requests a loan from a bank over its lending capacity or risk appetite. The main bank, which is also known as the. In many cases, moreover, these borrowers will effectively syndicate a loan themselves, using the arranger simply to craft documents and administer the process. A syndicated loan is one that is provided by a group of lenders and is structured, arranged, and administered by one or several commercial banks or investment. What are the stages of loan syndication process The first stage of the loan syndication process is the pre-mandate stage which is initiated by the borrower. Syndicated loan is a form of loan business in which two or more lenders jointly provide loans for one or more borrowers on the same loan terms and with. Syndicated loans are complex and may be risky given the credit quality of borrowers tapping the syndicated loan market may be below investment grade. Loan. When multiple banks or lenders come together to arrange for the loan requirement of a single borrower, it is referred to as a loan syndicate. Loan syndication is the process of multiple lenders coming together to fund a large loan requirement of a single borrower. This process is required when the. For banks involved in loan syndication, the three distinct stages of the process offer different levels of competition law risk. • Before the syndication group. Loan syndication is initiated by a client who requests a loan from a bank over its lending capacity or risk appetite. The main bank, which is also known as the. In many cases, moreover, these borrowers will effectively syndicate a loan themselves, using the arranger simply to craft documents and administer the process. A syndicated loan is one that is provided by a group of lenders and is structured, arranged, and administered by one or several commercial banks or investment. What are the stages of loan syndication process The first stage of the loan syndication process is the pre-mandate stage which is initiated by the borrower. Syndicated loan is a form of loan business in which two or more lenders jointly provide loans for one or more borrowers on the same loan terms and with.

) and for managing the loan syndication process of individual transactions. It is to spearhead all B loans and co-financing actions taken with lenders, e.g. process. Collaborative partnership. Beyond syndicated loan services, receive the benefit of our capital markets expertise and advisory capabilities to. A syndicated loan is structured, arranged and administered by the lead arranger or arranging bank — typically a commercial or investment bank. The lead arranger. We attract partners to invest alongside us as we provide capital to companies in developing countries—a process we call "mobilization." IFC's loan syndications. A syndicated loan is a loan offered by a group of lenders (called a syndicate) who work together to provide funds for a single borrower. Syndicated loans are a common source of corporate finance for large and medium-sized companies because the syndication process Commitment Letter: Lending . This programme provides a comprehensive course covering the purpose of syndicated lending, the motivations of participants and the key processes involved in. A syndicated loan, also known as a syndicated bank facility, is financing offered by a group of lenders (referred to as a syndicate) who. ) and for managing the loan syndication process of individual transactions. It is to spearhead all B loans and co-financing actions taken with lenders, e.g. In the context of the origination process the Service Domain Loan Syndication takes in a request for a loan that will require syndication. The request could. This manual is designed to help you to quickly get acquainted with the Loan Syndication process of Oracle Banking Corporate Lending Process Management (OBCLPM). What is Loan Syndication? Loan syndication is a lending process in which a group of lenders (called a syndicate) works together to provide. Syndicated loans involve groups of lenders, or “syndicates,” coming together to offer a single loan. If a borrower needs a large loan that a single lender is. Loan syndications and participations also permit lenders to reduce capital weight and provide financial accommodations to valuable clients whose credit needs. Borrowers entering the syndicated loan market seeking “new event” financing will continue to demand increasingly creative structures aimed at maximising the. Each lender in the syndicate contributes part of the loan amount, and they all share in the lending risk. One of the lenders acts as the manager (arranging bank). Loans Syndication process analyst provides comprehensive support and value-added services to the syndication business. The group primarily performs life. Loan syndication is one of the area in finance which has seen significant changes and it is the process of providing loan to borrower by many banks. As per. Syndicated loan is a form of loan business in which two or more lenders jointly provide loans for one or more borrowers on the same loan terms and with. A syndicated loan or syndicated bank facility is a large loan in which a group of banks work together to provide funds for a borrower.

Starter Investment Ideas

Investment Products at RBC. To protect your initial investment or explore opportunities Talk to us today and we'll help you start investing for your future in. This guide can help you figure out how much you can invest, the investment options available and how to choose the right investment funds for you. You don't need a degree in economics or a lot of money to start investing. You just need to learn some basics. You don't know how to start. Too many investors get caught up in learning all those different terms, concepts and ideas that they struggle to piece all of. You don't need a degree in economics or a lot of money to start investing. You just need to learn some basics. This mix is essentially how much of the various kinds of investments – such as shares, bonds, property or just plain cash – you hold. It's important to find out. The truth is, $1, is a great place to start investing and can make a difference in your financial health. Get expert tips, strategies, news and. - **Start Small**: You can start investing in stocks and bonds with a small amount of money, thanks to options like robo-advisors, mutual funds with low minimum. What are some good things to invest in for a beginner? · 0 to 3 months: Checking and savings account. · 3 months to 3 years: Short-term US. Investment Products at RBC. To protect your initial investment or explore opportunities Talk to us today and we'll help you start investing for your future in. This guide can help you figure out how much you can invest, the investment options available and how to choose the right investment funds for you. You don't need a degree in economics or a lot of money to start investing. You just need to learn some basics. You don't know how to start. Too many investors get caught up in learning all those different terms, concepts and ideas that they struggle to piece all of. You don't need a degree in economics or a lot of money to start investing. You just need to learn some basics. This mix is essentially how much of the various kinds of investments – such as shares, bonds, property or just plain cash – you hold. It's important to find out. The truth is, $1, is a great place to start investing and can make a difference in your financial health. Get expert tips, strategies, news and. - **Start Small**: You can start investing in stocks and bonds with a small amount of money, thanks to options like robo-advisors, mutual funds with low minimum. What are some good things to invest in for a beginner? · 0 to 3 months: Checking and savings account. · 3 months to 3 years: Short-term US.

5 stock investment tips for beginners · Consider Warren Buffett's advice: "Never invest in a business you cannot understand." Think about the companies that. We make the complicated stock market simple. We show you how to take advantage of the emotions in the market with lessons from successful strategies. On Kickstarter: , projects funded. $8,,, towards creative Why Content Creators are Turning to Crowdfunding to Fuel Their Ideas. Read. Step 1: Set Clear Investment Goals · Step 2: Determine How Much You Can Afford To Invest · Step 3: Determine Your Risk Tolerance and Investing Style · Step 4. You can break down your investments even further. For example, with large-cap stocks, you can invest in different sectors (like technology, health care, and. Don't start by asking "What should I invest in?" Instead, start by asking, "What am I investing for?" Many people start off by investing for retirement. Real estate represents a great investment opportunity, with numerous strategies available to begin making money. Not only can this investment vehicle make an. When should you start investing? If you've got plenty of money in your cash savings account – enough to cover you for at least three to six months – and you. Dividend investments. This can include dividend stocks as well as dividend index funds and exchange-traded funds (ETFs). · Bonds and bond index funds · High-yield. Instead lump sum investment SIP with long term is good strategy in stock market. For good stocks & investment idea. visit - follow shares2rich. When should you start investing? If you've got plenty of money in your cash savings account – enough to cover you for at least three to six months – and you. Start Investing. On eToro's Website. Your capital is at risk. How To Invest Get millions of investment ideas on eToro with the power of social investing. Before you start investing, you need to determine the best way to invest in the stock market and how much money you want to invest. · After you've answered these. “Investors have a lot of options these days—they can use a financial adviser or robo-advisor, they can open a brokerage account and invest on their own, or they. On StartEngine, everyday people can invest and buy shares in startups and early stage companies. Step 4: Your Investment options · Shares · Funds · Exchange Traded Funds (ETFs) · Investment Trusts · Bonds and Gilts. Instead lump sum investment SIP with long term is good strategy in stock market. For good stocks & investment idea. visit - follow shares2rich. Besides the traditional types of investments like stocks, real estate and bonds, there are a number of low-cost options with different levels of risks that you. There is no investment strategy anywhere that pays off as well as, or with less risk than, merely paying off all high interest debt you may have. If you owe. Speaking of things adding up, few investment strategies pay off as well as The best way to choose an investment professional is to start by asking.

Online Trading Websites

Investor's Edge is an online and mobile trading platform. Make smart trades with our mobile stock trading app for just $ a trade or less. In finance, an electronic trading platform also known as an online trading platform, is a computer software program that can be used to place orders for. The best online brokers for stocks in September · Charles Schwab · Fidelity Investments · Robinhood · E-Trade · Interactive Brokers · Merrill Edge · Ally Invest. Day and online trading with Xtrade | Trade Shares, Indices, Commodities, Forex and Cryptocurrencies with our trading platform. Trade anytime and anywhere. Start trading online with an award-winning Canadian broker. Our powerful forex & CFD trading platforms and apps are available on web, desktop and mobile. We set the standard with our unparalleled trading platform, enabling This may impact the content and messages you see on other websites you visit. TradeStation offers a full suite of advanced trading technology, online brokerage services, & education. Trade Stocks, ETFs, Options Or Futures online. Invest in stocks and ETFs without commission when buying and selling shares. Instant online stock trading. Awarded best online trading app 3 years in a row. Trade Forex Online with OANDA using powerful analysis tools, tight spreads, and low commissions. Learn more about smarter forex trading with OANDA here. Investor's Edge is an online and mobile trading platform. Make smart trades with our mobile stock trading app for just $ a trade or less. In finance, an electronic trading platform also known as an online trading platform, is a computer software program that can be used to place orders for. The best online brokers for stocks in September · Charles Schwab · Fidelity Investments · Robinhood · E-Trade · Interactive Brokers · Merrill Edge · Ally Invest. Day and online trading with Xtrade | Trade Shares, Indices, Commodities, Forex and Cryptocurrencies with our trading platform. Trade anytime and anywhere. Start trading online with an award-winning Canadian broker. Our powerful forex & CFD trading platforms and apps are available on web, desktop and mobile. We set the standard with our unparalleled trading platform, enabling This may impact the content and messages you see on other websites you visit. TradeStation offers a full suite of advanced trading technology, online brokerage services, & education. Trade Stocks, ETFs, Options Or Futures online. Invest in stocks and ETFs without commission when buying and selling shares. Instant online stock trading. Awarded best online trading app 3 years in a row. Trade Forex Online with OANDA using powerful analysis tools, tight spreads, and low commissions. Learn more about smarter forex trading with OANDA here.

Merrill Edge offers a wide range of investment products and advice, including brokerage and retirement accounts, online trading, and financial research. Why trade online with Fidelity · Competitive online commission rates · Free, independent research from 20+ providers · Margin, short selling, and options trading. Take aim at your future goals with an online experience. Easy-to-use website and mobile app; Broad range of account types; Insightful education and guidance. Enjoy trading with ease on desktop or mobile with Scotia iTRADE. Rich in educational resources, like in-depth research, analysis tools and market data. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, bonds and funds. Leading online trading solutions for traders, investors and advisors, with direct global access to stocks, options, futures, currencies, and bonds. Zerodha - India's biggest stock broker offering the lowest, cheapest brokerage rates for futures and options, commodity trading, equity and mutual funds. Join over 1 Million investors from around the world. Start investing Download the app Download the app. XTB Online Trading websites to help personalise your. Where the world charts, chats and trades markets. We're a supercharged super-charting platform and social network for traders and investors. Charles Schwab offers investment products and services, including brokerage and retirement accounts, online trading and more Other sites for advisors. Day and online trading with Xtrade | Trade Shares, Indices, Commodities, Forex and Cryptocurrencies with our trading platform. Trade anytime and anywhere. The 24 Hour Market is here. Trade TSLA, AMZN, AAPL, and more of your favorite stocks and ETFs 24 hours a day, 5 days a week. Seamlessly trade and manage your investments across mobile, web, and desktop. trade U.S. listed securities via mobile devices, desktop or website products. Firstrade Securities offers investment products and tools to help you take control of your financial future. Experience commission-free trading with us. trading. Content, research, tools, and stock symbols on eToro's website are for educational purposes only and do not imply a recommendation or solicitation. DEGIRO is Europe's fastest growing online stock broker. DEGIRO distinguishes itself from its competitors by offering extremely low trading commissions. Passionate about the markets? E*TRADE offers a compelling mix of intuitive tools, competitive pricing, and dedicated service for those who love to trade. TradeZero commission free stock trading software lets you trade and locate stocks from any device and includes real-time streaming and direct market access. Open a trading account and start trading options, stocks, and futures at one of the top trading brokerages in the industry website and brokerage services are. DEGIRO is Europe's fastest growing online stock broker. DEGIRO distinguishes itself from its competitors by offering extremely low trading commissions.

Citi Checking Plus

Everyday Benefits · $0 to $29, · Features & Benefits Include: Access to Citi Mobile® App, online banking and 65,+ fee-free ATMs nationwide ; Citi Priority. Additional accounts must be owned by the same individual who owns the Personal Checking Plus account. Using your Citibank Banking Card® at any Citibank. Automatic Teller Machine (ATM) location: You may use your Citibank Banking Card to obtain a loan directly. Check today's Citibank® rates on checking and savings accounts, CDs, IRAs, personal loans & lines of credit. Open an account today. Interest Checking Plus The second form of identification includes: Social Security Card, Birth Certificate, Voter Registration card, a credit or bank card. First Citizens National Bank in Tennessee is the best at providing Unbelievably Good personal and business banking services. Checking and saving accounts. Make bounced checks history with Safety Check –– overdraft protection that transfers funds from your Citibank savings account to your checking account. Check today's Citibank® rates on checking and savings accounts, CDs, IRAs, personal loans & lines of credit. Open an account today. To open a new checking account online, you'll enter basic information, such as your address and Social Security number and choose funding options. Everyday Benefits · $0 to $29, · Features & Benefits Include: Access to Citi Mobile® App, online banking and 65,+ fee-free ATMs nationwide ; Citi Priority. Additional accounts must be owned by the same individual who owns the Personal Checking Plus account. Using your Citibank Banking Card® at any Citibank. Automatic Teller Machine (ATM) location: You may use your Citibank Banking Card to obtain a loan directly. Check today's Citibank® rates on checking and savings accounts, CDs, IRAs, personal loans & lines of credit. Open an account today. Interest Checking Plus The second form of identification includes: Social Security Card, Birth Certificate, Voter Registration card, a credit or bank card. First Citizens National Bank in Tennessee is the best at providing Unbelievably Good personal and business banking services. Checking and saving accounts. Make bounced checks history with Safety Check –– overdraft protection that transfers funds from your Citibank savings account to your checking account. Check today's Citibank® rates on checking and savings accounts, CDs, IRAs, personal loans & lines of credit. Open an account today. To open a new checking account online, you'll enter basic information, such as your address and Social Security number and choose funding options.

With the Citigold Relationship Tier, you'll receive Citi Priority benefits plus Requires a checking account and Citi Priority, Citigold or Citigold Private. Our Commercial Checking Plus account is ideal for businesses with a large volume of checks and multiple cash management services (additional fees apply). Earn Premier relationship rates when you link the account to a Chase Premier Plus CheckingSM or Chase SapphireSM Checking account, and make at least five. Simpler All Mobile Account*: Open a checking or savings account right from the app without setting foot in a bank branch Card Replacement: Request a new. The website says it comes with a % interest rate, is the interest automatically being deducted from the checking account each month? Alliant Credit Union gives you more for your money with online banking, award-winning savings and checking accounts, credit cards, and loans Plus, no. Plus Checking℠ and Chase Private Client Checking℠ accounts earn interest. Citibank offers two savings account options—Citi® Accelerate Savings and Citi Basic. Citibank offers multiple banking services that help you find the right credit cards, open a bank account for checking, & savings, or apply for mortgage. Simpler All Mobile Account*: Open a checking or savings account right from the app without setting foot in a bank branch. Fast Navigation: Quickly get to. BankPlus offers personal and business banking, checking, mortgages, loans, investing & more. Visit us online or at one of our locations. Everyday benefits · You may deposit checks into your account that are returned, regardless of whether or not your account is overdrawn. · 65,+ Fee-Free ATMs. of Credit. Checking Plus is a revolving personal line of credit account linked to your Citibank. Checking account that provides overdraft protection. 06/27/ The Balance Range to remain in the Citi Priority Relationship Tier is $30,$, If you are automatically Re-Tiered, we'll inform you of your new. Checking that grows with you. Plus $ All-new TD Complete Checking's right for all life stages. And new customers earn $ with qualifying activities. Get. Get % cash back with your Citizens Cash Back Plus™ World Mastercard®. Better deposit rates3. At least 25% higher rates on Citizens Quest® Savings and. When you open a City National Bank Personal Checking Plus account, you can enjoy a free savings or money market account. Visit our site for details. With Member's Choice Plus Checking, you can order checks if you would like or just use your debit card. This account has the flexibility you need. Prime. Secure Plus Checking · Everything our Secure Checking account offers and · Cash Back Member Rewards · Health Discount Savings · Accidental Death &. The protection you need, the flexibility you want. A Checking Plus® account provides the overdraft protection you need to make bounced checks a thing of the. Sorry, joint Citi Plus accounts are not available at this time. Citi Plus currently provides personal banking services. If you are holding any joint account.

Does Enterprise Negotiate Car Sales

I definitely recommend enterprise at hempstead to everyone that is looking for new, affordable, and beautiful car. Everyone was very helpful, honest, and didn'. Learn about the insurance coverage options for rental cars and what you can expect after an accident Buy. Enterprise Car Sales. Share. Enterprise CarShare. Can you negotiate price with Enterprise? Enterprise has a no-haggle car buying policy. If you want to pay a lower price for a car, you'll either need to. Enterprise Car Sales – a car dealership with no-haggle pricing; Major World – one of New York's premier used car dealerships; Nick's Auto Sales Co – impressive. Can you negotiate price with Enterprise? Enterprise has a no-haggle car buying policy. If you want to pay a lower price for a car, you'll either need to. At Donohoo Auto, we do things differently. There are no back and forth negotiations, haggling, or uncertainty. Instead, the price you see is the price you get. You will appreciate our no-haggle car pricing so you can avoid unpleasant negotiations and sales games at our Iselin car dealership. Inventory Online. Search. We have teamed up with Enterprise to provide AAA members a convenient way to trade-in or sell your car. Connect with a local Enterprise Car Sales Consultant. Enterprise Car Sales FAQ Can you negotiate with Enterprise Car Sales? Enterprise Car Sales doesn't allow negotiations on vehicle pricing. The company's no-. I definitely recommend enterprise at hempstead to everyone that is looking for new, affordable, and beautiful car. Everyone was very helpful, honest, and didn'. Learn about the insurance coverage options for rental cars and what you can expect after an accident Buy. Enterprise Car Sales. Share. Enterprise CarShare. Can you negotiate price with Enterprise? Enterprise has a no-haggle car buying policy. If you want to pay a lower price for a car, you'll either need to. Enterprise Car Sales – a car dealership with no-haggle pricing; Major World – one of New York's premier used car dealerships; Nick's Auto Sales Co – impressive. Can you negotiate price with Enterprise? Enterprise has a no-haggle car buying policy. If you want to pay a lower price for a car, you'll either need to. At Donohoo Auto, we do things differently. There are no back and forth negotiations, haggling, or uncertainty. Instead, the price you see is the price you get. You will appreciate our no-haggle car pricing so you can avoid unpleasant negotiations and sales games at our Iselin car dealership. Inventory Online. Search. We have teamed up with Enterprise to provide AAA members a convenient way to trade-in or sell your car. Connect with a local Enterprise Car Sales Consultant. Enterprise Car Sales FAQ Can you negotiate with Enterprise Car Sales? Enterprise Car Sales doesn't allow negotiations on vehicle pricing. The company's no-.

Recommended Reviews - Enterprise Car Sales. Your trust is our top concern, so businesses can't pay to alter or remove their reviews. With Auto Expert and Enterprise Car Sales 1, our exclusive auto partners Let the experts search for your dream car, new or used, negotiate the price and even. We can also beat dealer advertised prices which are usually used by New Car Dealers to entice you into visiting their dealership. Their goal is to get you into. Enterprise doesn't negotiate. If they can't sell it the put it back in the rental fleet as needed, or sit in it, at least that's how the one by. Enterprise car sales often provide used non-negotiable car prices. This is because they focus on giving customers the best possible dealerships without the. In my experience, they won't haggle, but they do give you a good price. I wasn't able to beat their price even after doing a lot of calling. Enterprise's deep understanding of the industry, dealer connections, and team of ASE-certified maintenance representatives enable us to review and negotiate all. Shop our inventory, estimate your trade-in value and monthly payments, schedule a test drive and apply for financing – all from home. Enterprise Car Sales makes. Dealerships need five reviews in the past 24 months before we can display an overall rating. Filter Reviews by Keyword. price negotiate arbitration order. In most cases if you work, you will be able to drive one of our pre-approved cars in New York. We can approve you for car loans with no downpayment or no. Tips and advice on the used car buying process from Enterprise Car Sales, including insight on financing, pricing, warranties and transfer. Compliance with company policies · Ability to forecast spend based on negotiated mid-size rates · Vehicle upgrades with no cost, plus increased satisfaction among. There's no gimmicks, and with our no-haggle prices, there's no need to negotiate to get a great deal on a used car at Hertz Car Sales. The shopping process is. Shop around, compare offers, and negotiate the best deal you can. If you decide to finance the car, make sure you understand the financing agreement before you. Budget Car Sales of Harrisburg sells and services vehicles in the greater Middletown PA area. Do dealerships negotiate anymore? In most cases, you'll still need to negotiate the value of your trade, the cost of financing and the price of any add-ons. If. We've removed the stress and need to negotiate with our competitive pricing. Can I have a third-party mechanic inspect the vehicle before buying it? Yes, while. Buy the car and we'll waive the rental charges. In most states, you can purchase it from home. Try. “Enterprise Car Sales purchasing process was seamless and efficient. Chris Moro, the sales rep that took care of my transaction was polite and efficient, he did. Prices displayed are based on average sales data and can sometimes differ from the actual price you might be able to negotiate. Carmax. Pros: Extensive.

Easy Send Money Online

A fast, easy way to send money to and within the United States. How much do you want to send for cash pickup, bank or debit card deposit? Easy. Safe. Convenient Send Money Online. Sign up now and start sending money using your debit card, credit card or bank account. Track Money Transfers. Trust MoneyGram, Ria & Western Union. More ways to send. Choose cash pickup, bank deposit, mobile wallet & more. It's easy to transfer money online between Wells Fargo accounts, to another person, or to another financial institution. Fast — Send money to friends and family in minutes · Safe — Use Zelle® within the secure EverBank mobile app and online banking · Easy — You can send money to or. 1. Paypal: Best overall · 2. Venmo: Best for sending money · 3. Cash App: Best if you like options · 4. Google Pay: Best for Google suite users · 5. Apple Pay: Best. Sending money is easy with Wise app. Cheaper transfers abroad - free from hidden fees and exchange rate markups. Check exchange rates - see on the app how. PayPal can be an economical method for transferring money. It allows individuals and businesses to transfer funds electronically from one PayPal account to. Send money internationally online from the United States to a bank account, debit card, mobile phone, mobile wallet or a MoneyGram location globally abroad. A fast, easy way to send money to and within the United States. How much do you want to send for cash pickup, bank or debit card deposit? Easy. Safe. Convenient Send Money Online. Sign up now and start sending money using your debit card, credit card or bank account. Track Money Transfers. Trust MoneyGram, Ria & Western Union. More ways to send. Choose cash pickup, bank deposit, mobile wallet & more. It's easy to transfer money online between Wells Fargo accounts, to another person, or to another financial institution. Fast — Send money to friends and family in minutes · Safe — Use Zelle® within the secure EverBank mobile app and online banking · Easy — You can send money to or. 1. Paypal: Best overall · 2. Venmo: Best for sending money · 3. Cash App: Best if you like options · 4. Google Pay: Best for Google suite users · 5. Apple Pay: Best. Sending money is easy with Wise app. Cheaper transfers abroad - free from hidden fees and exchange rate markups. Check exchange rates - see on the app how. PayPal can be an economical method for transferring money. It allows individuals and businesses to transfer funds electronically from one PayPal account to. Send money internationally online from the United States to a bank account, debit card, mobile phone, mobile wallet or a MoneyGram location globally abroad.

Enjoy a $0 transfer fee* on your first transfer with Western Union®. Send money fast to Mexico and globally from the US, available 24/7. Send money, track. Xoom is a PayPal service. We're part of something bigger, something that empowers over million customers around the world to make secure online transactions. It's easy to transfer money. Move money between your U.S. Bank accounts – and to and from accounts at other banks. With U.S. Bank mobile and online banking. Send money online, at home or on the go. The Xe app has everything you need for international money transfers. It's easy, secure, and has no surprise fees. International money transfer from the United States. Send money online to over countries around the world starting at $ A love note, a banknote, a money transfer — so many ways to show them you care. Easily send money abroad and be there for them when they need you most. Purchase. It's easy to transfer money. Move money between your U.S. Bank accounts – and to and from accounts at other banks. With U.S. Bank mobile and online banking. International money transfer. WorldRemit makes international money transfers fast, flexible, and fair. It's easy to transfer money online between Wells Fargo accounts, to another person, or to another financial institution. At Remitly, our transfer process is quick, affordable, and secure. We'll provide you with the total cost and delivery time before you send your transfer. How to send money · 1. Log in to the Western Union app. · 2. Start a transfer. Enter the destination and amount. · 3. Enter your receiver's name and mobile number. Try our secure and easy-to-use money transfer app Send money on the go with the Ria app. Check for great rates, enjoy faster repeat transfers with a few taps. With millions of downloads, the MoneyGram money transfer app is an easy way to send money internationally with great foreign exchange rates. Now, iOS users. Trusted by millions worldwide, the Remitly app allows you to send fast and secure money transfers to banks and approximately ,+ cash pickup locations. Disadvantages of Transferring Money · Though electronic money transfer systems are generally easy to use, you need some basic technology skills to create and. Join the millions of people who have trusted Remitly since to send money to friends and family overseas. More money makes it home to loved ones with. Zelle®: A fast and easy way to send money Whether you're paying the sitter, settling up on a group gift or paying for your part of the pizza, all you need is. Zelle®: A fast and easy way to send money Whether you're paying the sitter, settling up on a group gift or paying for your part of the pizza, all you need is. Use a money-transfer app. If you have the email or US mobile number of the recipient, you may be able to send money securely using an online service or app. Send, request, and transfer money online with PayPal. Find out more about how easy it is to send and receive money with our secure app.

How To Calculate House Area

Measure the length of the area and the width of the area (in feet). · Then multiply those two numbers together and you will have the total square footage or area. You will want to measure and multiply the area length times the width in feet until the square footage is 1, sq. ft. and mark off this area with a marking. This free calculator estimates the square footage of a property and can account for various common lot shapes. In mathematics, square footage is the measurement to calculate the area. The area is generally measured for any two-dimensional shapes that contain the set of. One can measure the exterior width x length if a one store square house, that is one way. One can use a tape measure and measure the interior. Multiply the length of the first space by the width of the first space. To find the square footage -- or the area -- of the space, just multiply the length. Accordingly, the larger the size of a property or area, the higher the cost required to paint it. house makes it more difficult to estimate cost per square. Go room by room, measuring the length and width. Then, multiply those figures by one another to get the square footage of that space. Square footage of a house (GLA). For most people, the gross floor area or gross living area (GLA) of a home is what they're thinking when they hear “square. Measure the length of the area and the width of the area (in feet). · Then multiply those two numbers together and you will have the total square footage or area. You will want to measure and multiply the area length times the width in feet until the square footage is 1, sq. ft. and mark off this area with a marking. This free calculator estimates the square footage of a property and can account for various common lot shapes. In mathematics, square footage is the measurement to calculate the area. The area is generally measured for any two-dimensional shapes that contain the set of. One can measure the exterior width x length if a one store square house, that is one way. One can use a tape measure and measure the interior. Multiply the length of the first space by the width of the first space. To find the square footage -- or the area -- of the space, just multiply the length. Accordingly, the larger the size of a property or area, the higher the cost required to paint it. house makes it more difficult to estimate cost per square. Go room by room, measuring the length and width. Then, multiply those figures by one another to get the square footage of that space. Square footage of a house (GLA). For most people, the gross floor area or gross living area (GLA) of a home is what they're thinking when they hear “square.

Once they get that basic square footage number, they begin subtracting where needed to get the “Gross Living Area” or GLA of the home, which includes all. To calculate the square footage of an area, you first need to find the required dimensions for the appropriate shape. For example, for a rectangular room in. Measurements of distances may not be % accurate, especially in areas with 3D terrain and buildings. For best results, measure using a top-down view. Tips. This is done by using the formula: Length (in feet) x Width (in feet) = Area (in square feet). Sum Up the Areas: Add up the calculated area of all rooms or. The two dimensions to measure are the length and width of the area you need to calculate. Tip: The square footage of a house usually includes finished. This free calculator estimates the square footage of a property and can account for various common lot shapes. Some dwellings have bay windows or circular areas that jut out from the house. Split irregular shapes into easy to calculate areas, such as triangles or. Multiply your house length by your house width to get the area. (For example, 40 feet x 30 feet = 1, square feet.) Next, multiply the area by your roof's. Then calculate the area of the individual recesses by measuring their length and width. Lastly, add all of the areas together to get the total area of the room. You just multiply the length of a room or house in feet by the width in feet. The basic formula for square feet: Length x Width = total area square footage. How to calculate square footage of a house? · For square or rectangular rooms, use the formula: Area = Length x Width. · For triangular rooms, use the formula. For rectangular homes, you can just take the area of the building. A one-story ranch measuring 50 feet by 40 feet would therefore have square footage of 2, The easiest way to measure the acreage of a plot of land is to start by entering an address that is associated with the plot of land you need the area of. The farmer must now determine whether he has sufficient area in his backyard to house a pool. The equation for calculating the area of an ellipse is similar. If there are spaces within rooms that are not part of the living area, such as built-in areas, subtract their area from the total square footage. These steps. To calculate the square feet area of a square or rectangular room or area, measure the length and width of the area in feet. Then, multiply the two figures. Depending on the room's shape, finding the area might be as simple as multiplying two dimensions. It might also involve a little more complex math. For instance. It can also be used to help calculate the sum insured where a dollar amount is the maximum that the insurer will pay. If the area of a property advised to the. To find the area of a rectangular room, we will multiply the length by the width. Length x Width = Square Footage. For example, say you've measured the distance. The simplest (and most commonly used) area calculations are for squares and rectangles. To find the area of a rectangle, multiply its height by its width. Area.

What Is Loan Value

A loan-to-value ratio (LTV) is a number that shows how much money is being borrowed in comparison to the value of the collateral. LTV has significant. The loan-to-value (LTV) ratio is a risk-assessment tool that we use to analyze your mortgage application. The higher the LTV, the more it will usually cost. LTV is a number, expressed as a percentage, that compares the size of the loan to the lower of the purchase price or appraised value of the property. Loan to value is the percentage of borrowing you take out against your home. For example, if you have a £, mortgage on a £, house, the loan to value. LTV is the ratio of your loan to the value of your Collateral. When you borrow a loan, we calculate your loan amount or required Collateral based on the. LTV, or loan-to-value, is a ratio that compares a loan amount to the value of the property being financed. The loan-to-value ratio (LTV) looks at the market value of your assets to to calculate the maximum amount you can obtain through a secured loan. An LTV ratio is a number — expressed as a percentage — that compares two things: your mortgage size and the value of the home you're buying or refinancing. What is LTV (Loan-to-Value)?. LTV represents the proportion of an asset's value that a lender is willing to provide debt financing against. It's usually. A loan-to-value ratio (LTV) is a number that shows how much money is being borrowed in comparison to the value of the collateral. LTV has significant. The loan-to-value (LTV) ratio is a risk-assessment tool that we use to analyze your mortgage application. The higher the LTV, the more it will usually cost. LTV is a number, expressed as a percentage, that compares the size of the loan to the lower of the purchase price or appraised value of the property. Loan to value is the percentage of borrowing you take out against your home. For example, if you have a £, mortgage on a £, house, the loan to value. LTV is the ratio of your loan to the value of your Collateral. When you borrow a loan, we calculate your loan amount or required Collateral based on the. LTV, or loan-to-value, is a ratio that compares a loan amount to the value of the property being financed. The loan-to-value ratio (LTV) looks at the market value of your assets to to calculate the maximum amount you can obtain through a secured loan. An LTV ratio is a number — expressed as a percentage — that compares two things: your mortgage size and the value of the home you're buying or refinancing. What is LTV (Loan-to-Value)?. LTV represents the proportion of an asset's value that a lender is willing to provide debt financing against. It's usually.

Loan value definition: the highest amount of money that can be borrowed against a life-insurance policy, based on the cash value of the policy. The loan-to-value ratio is a measurement of the risk lenders consider when finalizing and approving a mortgage. The loan-to-value ratio, or LTV, is a measure of the relationship between the loan amount and the value of the commercial real estate (collateral). Calculate the equity available in your home using this loan-to-value ratio calculator. You can compute LTV for first and second mortgages. The meaning of LOAN VALUE is the amount which the owner may borrow against a life insurance policy, equal to the cash value less interest to the end of the. Use this calculator to determine your LTV ratio, which expresses the percent of your home's value that's covered by your loan. The loan to value ratio can be used for many different purposes. Investors often use the LTV ratio when making key decisions about when to sell or refinance. A. Key Points. LTV ratio measures debt as a percent of asset value, crucial in evaluating loan risk. For conventional loans, an 80% LTV requires mortgage insurance. Loan to value – or LTV – is the ratio of the value of the home you want to buy and the loan you'll need to buy it, shown as a percentage. How to Calculate LTV for a Car Loan. Your LTV for your car loan is simply the ratio of your loan amount to the market value of your car. LTVs are usually. Loan-to-value ratio The loan-to-value (LTV) ratio is a financial term used by lenders to express the ratio of a loan to the value of an asset purchased. Loan-to-value ratio explains the relationship between the amount you borrow and the value of the car the loan uses for collateral. Loan value definition: the highest amount of money that can be borrowed against a life-insurance policy, based on the cash value of the policy. What is a loan-to-value ratio? A loan-to-value (LTV) ratio is an expression of the amount of your loan as a total percentage of the value of the purchased. An LTV ratio is a number — expressed as a percentage — that compares two things: your mortgage size and the value of the home you're buying or refinancing. How to Calculate LTV for a Car Loan. Your LTV for your car loan is simply the ratio of your loan amount to the market value of your car. LTVs are usually. Divide the original loan amount plus the financed mortgage insurance by the property value. (The property value is the lower of the sales price or the current. As a matter of general thumb rule, lenders and traditional lending institutions consider Loan-To-Value ratios that are lesser than or equal to 80% to be a good. Key Points. LTV ratio measures debt as a percent of asset value, crucial in evaluating loan risk. For conventional loans, an 80% LTV requires mortgage insurance. Loan-to-value ratio (or LTV) is a percentage that's calculated by dividing your mortgage by the value of your home.

Is The Apple Card Good For Beginners

The Apple card does not charge late fees, over the limit fees, returned payment fee, international fees, or an annual fee. There is no penalty APR. When. Apple Card, that the individuals who raised concerns tended to have good access to credit otherwise, and that the problems might have been prevented by better. Apple Card eliminates fees, provides innovative tools for managing your spending and reducing your interest, helps you build your savings, and as an Apple. Apple makes it easy to add a credit card. The application takes no time at all and the rates are best available! Being a part of Apple Federal Credit Union. Earlier this week, Apple began the public rollout of its new Apple Card to everyone in the United States. The new credit card created by the. Compare any of our Personal Cards to find the one that's right for you. A Tool for Finding the Right Offer. Get matched with a personalized set of Card offers. Want to merge credit lines with a partner or help your teens learn better spending habits? The Apple Card offers its Apple Card Family feature, which allows you. Using the card via Apple Pay, either online or at a point-of-sale terminal will merit a user 2% to 3% cashback in the form of Apple Cash. ○ 3% cash back at. Is the Apple Card Right for Me? · Use Apple Pay. · Prefer no fees and simple rewards. · Want same-day access to the cash back you earn. The Apple card does not charge late fees, over the limit fees, returned payment fee, international fees, or an annual fee. There is no penalty APR. When. Apple Card, that the individuals who raised concerns tended to have good access to credit otherwise, and that the problems might have been prevented by better. Apple Card eliminates fees, provides innovative tools for managing your spending and reducing your interest, helps you build your savings, and as an Apple. Apple makes it easy to add a credit card. The application takes no time at all and the rates are best available! Being a part of Apple Federal Credit Union. Earlier this week, Apple began the public rollout of its new Apple Card to everyone in the United States. The new credit card created by the. Compare any of our Personal Cards to find the one that's right for you. A Tool for Finding the Right Offer. Get matched with a personalized set of Card offers. Want to merge credit lines with a partner or help your teens learn better spending habits? The Apple Card offers its Apple Card Family feature, which allows you. Using the card via Apple Pay, either online or at a point-of-sale terminal will merit a user 2% to 3% cashback in the form of Apple Cash. ○ 3% cash back at. Is the Apple Card Right for Me? · Use Apple Pay. · Prefer no fees and simple rewards. · Want same-day access to the cash back you earn.

With the Apple Credit Card, you can earn cash-back rewards for every purchase. And the best part? You get 3% cash back on purchases made from Apple, 2% on. Although the company doesn't offer a business credit card, Apple Card's unique features may be beneficial for self-employed individuals and small business. For US residents, the Apple Card is not a competitive credit card. There are enough credit cards with no annual fees offering at least 2% cash back on all. The Apple Card is, admittedly, a credit card. Although there are no fees, you must pay interest on the borrowed funds. When using an Apple Card to purchase a. Apple Card eliminates fees, 3 provides innovative tools for managing your spending and reducing your interest, helps you build your savings. Healthy finances. Family style. · Two kinds of users. The right fit for everyone. · Co‑Owners are equal partners. · Participants learn healthy financial habits. card that's right for you. You don't even need to visit a branch—apply Apple and the Apple logo are trademarks of Apple Inc., registered in the. Individuals with excellent credit scores could qualify for an APR on the low end of the % to %, which is a better rate than the national average APR. You will be eligible to receive a complimentary Apple iPad (Apple 10th Generation Wi card remains in good standing and you remain an SNL account owner. Compare credit cards with our easy-to-use tool and find out which cash back, rewards, travel, lifestyle, no fee or low interest credit card works best for. If you successfully complete the program, you will receive an invitation to reapply for Apple Card that's good for 14 days The monthly credit review required. Apple Card is a better kind of credit card. And with Apple Card Monthly Installments, you can pay for a new iPhone with interest-free payments. The Ridiculously Simple Guide to Apple Services: A Beginners Guide to Apple Arcade, Apple Card, Apple Music, Apple TV, iCloud: La Counte. Without question, the Apple Card is definitely best suited for those who are big fans of Apple and Apple products, and those who use Apple Pay to complete most. 3% on Apple purchases, be it hardware or digital transactions, is perhaps a bit better, but with cards readily giving 4 mpd on such purchases, it's not much to. The largest company in the world now offers customers its own credit card, the Apple Card. Apple has long been adored by tech enthusiasts and consumers. Enjoy now and pay later when you shop Interest Free with your CreditLine card at Apple. Is this Credit Card right for me? Gambling and lottery. It builds upon the Apple Pay movement in that it touts simplicity, ease of use and security. It also is claiming to be the first credit card that will encourage. Individuals with excellent credit scores could qualify for an APR on the low end of the % to %, which is a better rate than the national average APR. Apple Card eliminates fees, 3 provides innovative tools for managing your spending and reducing your interest, helps you build your savings.

1 2 3 4 5 6 7 8 9